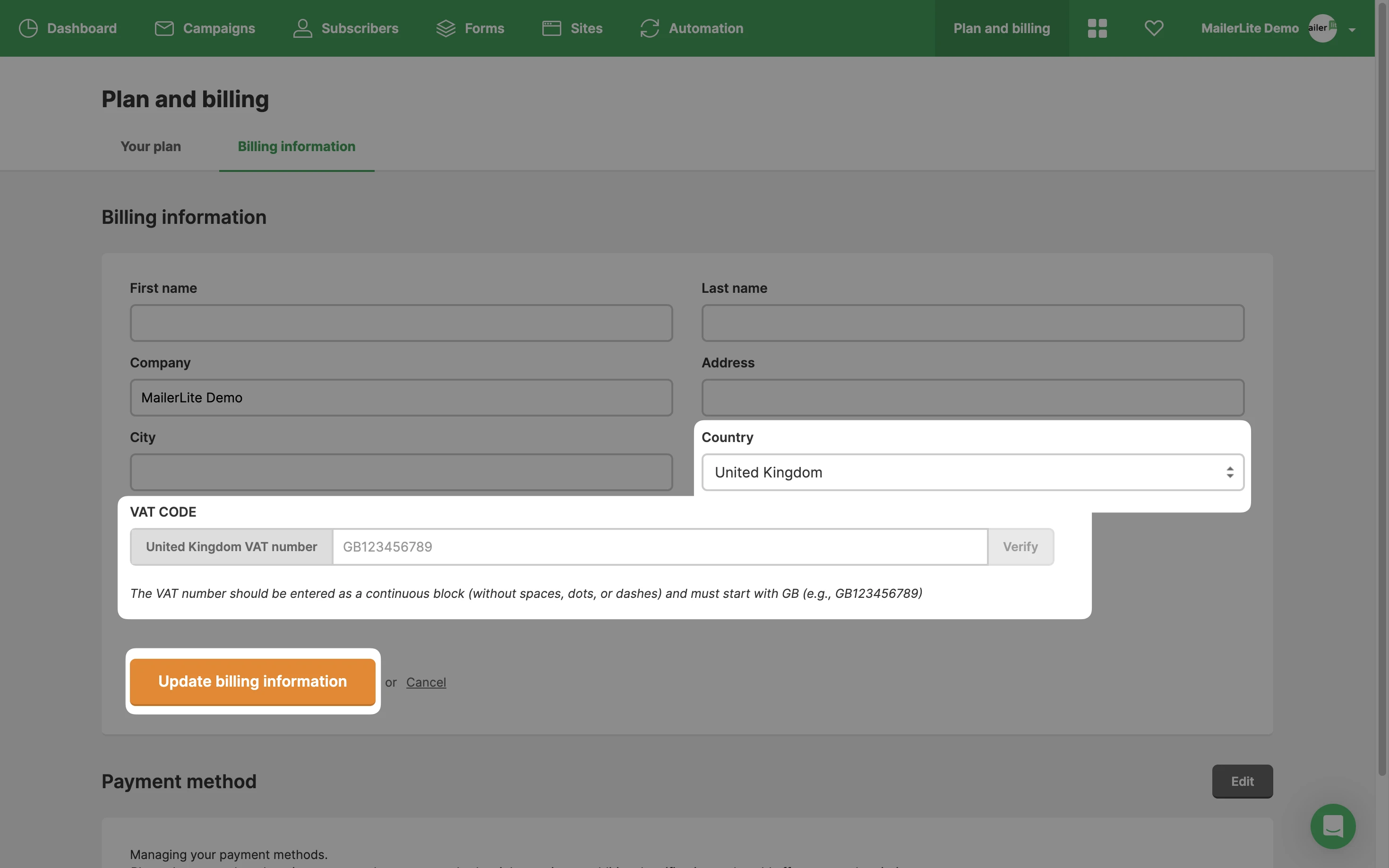

Starting June 1st, 2021, MailerLite is required to apply VAT to payments from UK based customers that did not provide a valid UK VAT number. This tax will be added automatically to your MailerLite invoices.

In the event of a refund, the VAT charge will be included in the reimbursement.

How to add the UK VAT number

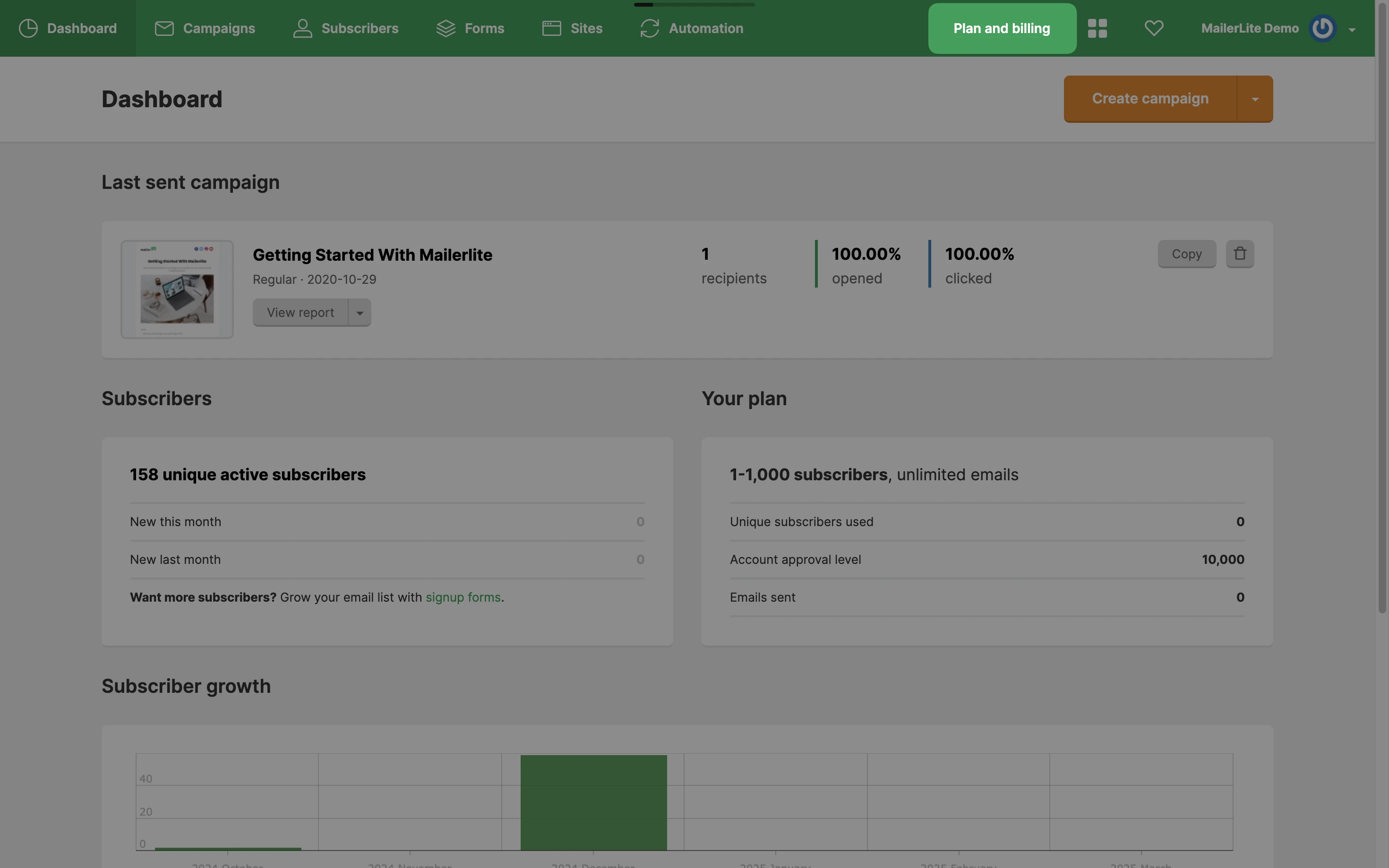

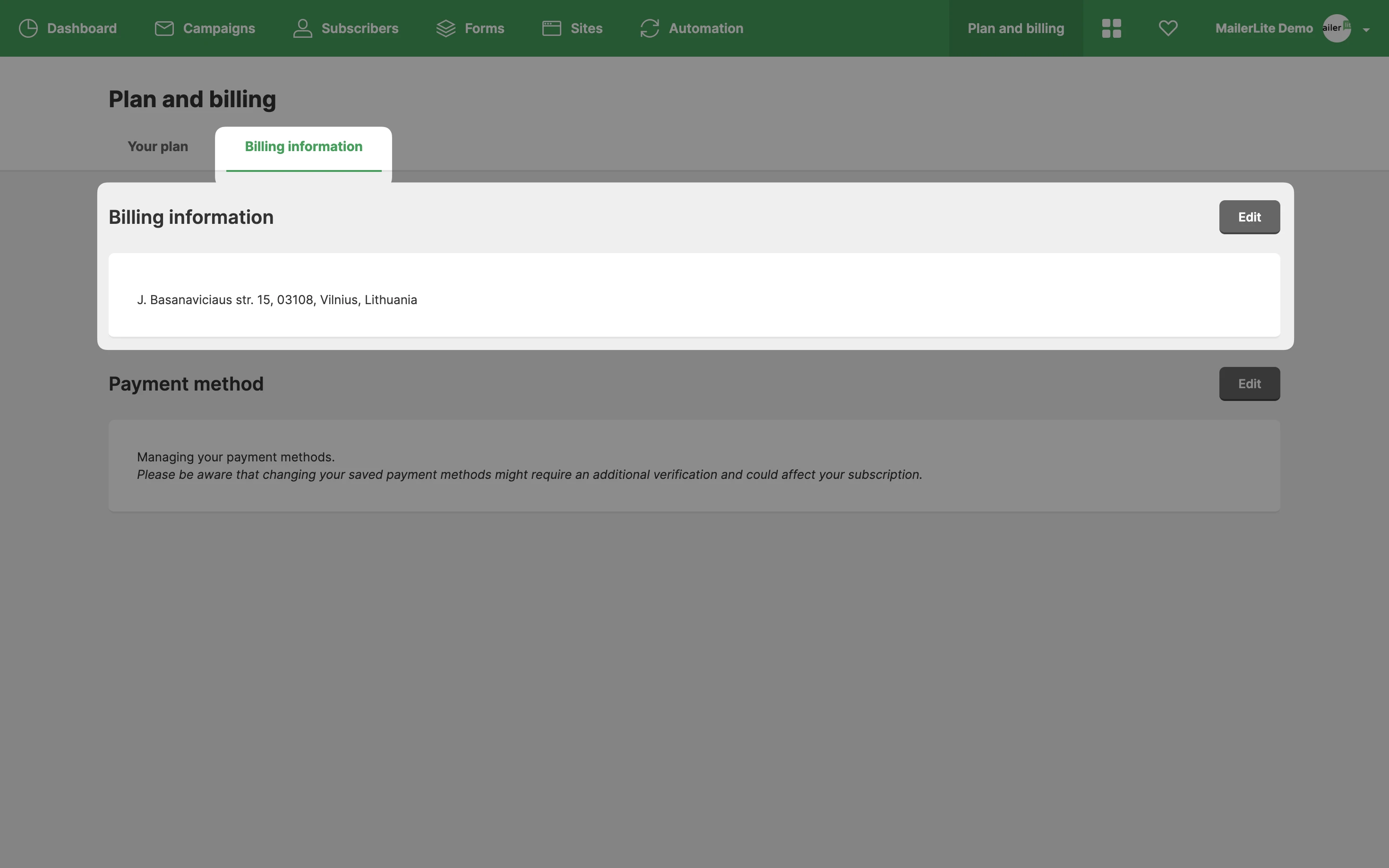

You can add your VAT number on the Plan and billing page under the Billing information tab.

Based on this information, our billing platform will calculate the applicable tax rate on top of the plan price on the checkout page.