MailerLite is growing its client base across the United States. By law, we need to collect and remit sales taxes to comply with varying local and state laws across the country.

Not all states tax our activity as a Software as a Service (SaaS), and there are different nexus determinations across states.

Below you will find an up-to-date table with the information in what states we are subject to sales taxes.

In the event of a refund, the state and local taxes will be included in the reimbursement.

States subject to a sales tax

MailerLite is subject to sales tax in the following states:

| State | Effective date |

| Ohio | March 22nd, 2021 |

| Utah | April 1st, 2021 |

| Maryland | June 1st, 2021 |

| District of Columbia | June 1st, 2021 |

| Arizona | October 1st, 2022 |

| Pennsylvania | October 1st, 2022 |

| Massachusetts | October 1st, 2022 |

| Washington | October 1st, 2022 |

| New York | September 1st, 2024 |

| Texas | September 1st, 2024 |

| Kentucky | November 1st, 2024 |

| West Virginia | November 1st, 2024 |

| Vermont | November 1st, 2024 |

| Tennessee | November 1st, 2024 |

| Alaska | November 1st, 2024 |

This list will be updated as more states are added.

How a US sales tax is calculated

A sales tax is calculated by the addition of:

The state rate

The county rate

The city rate (if applicable)

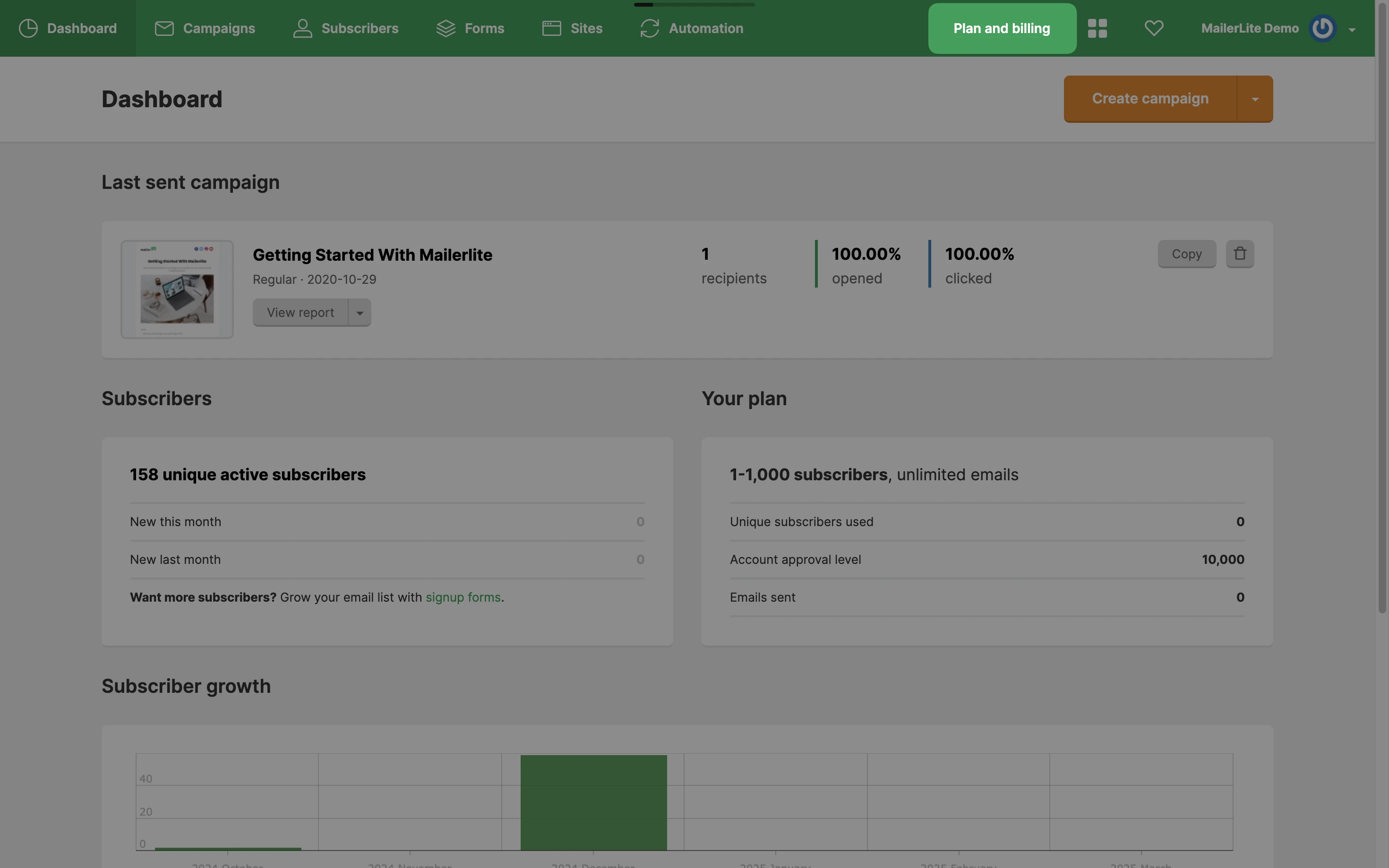

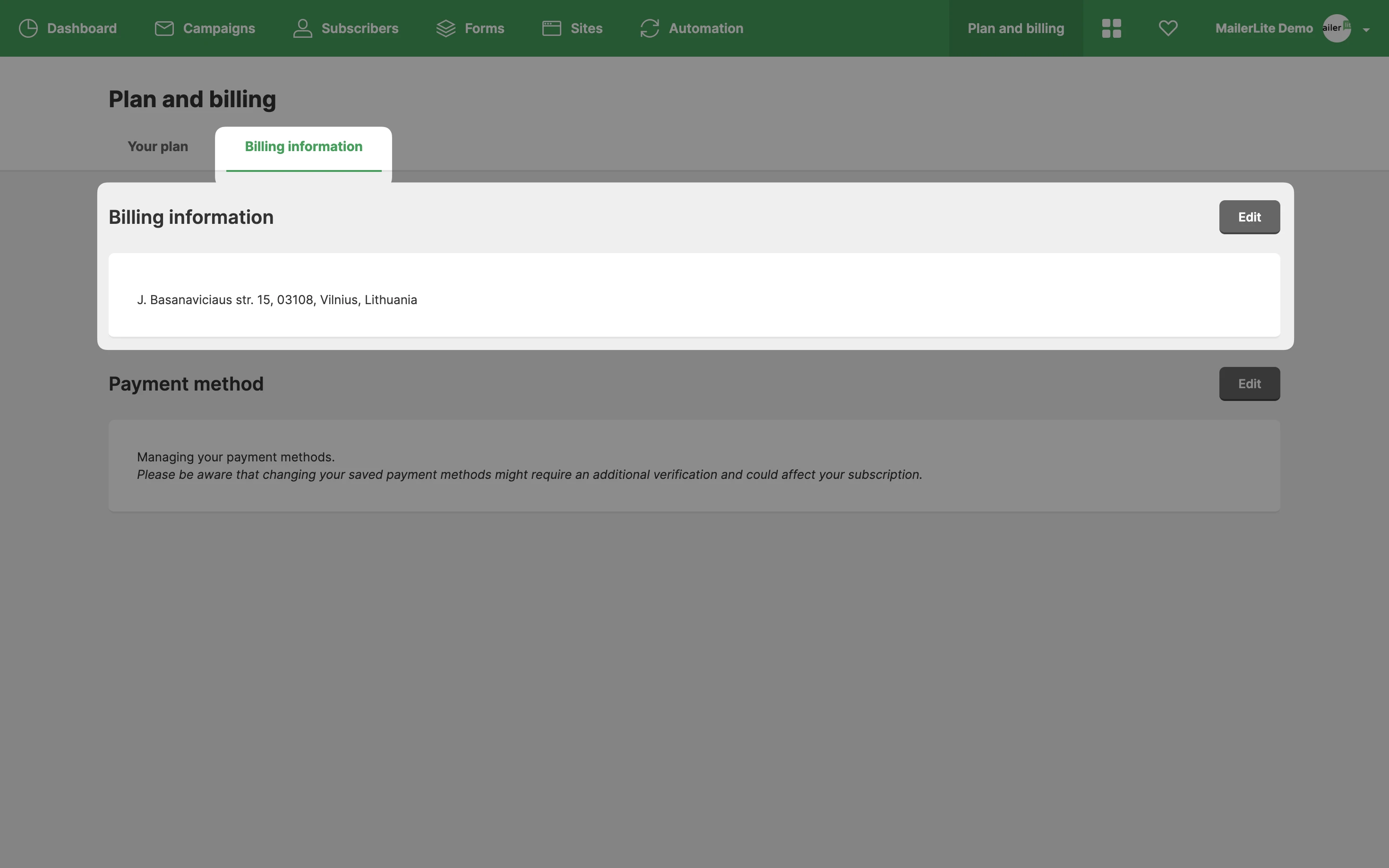

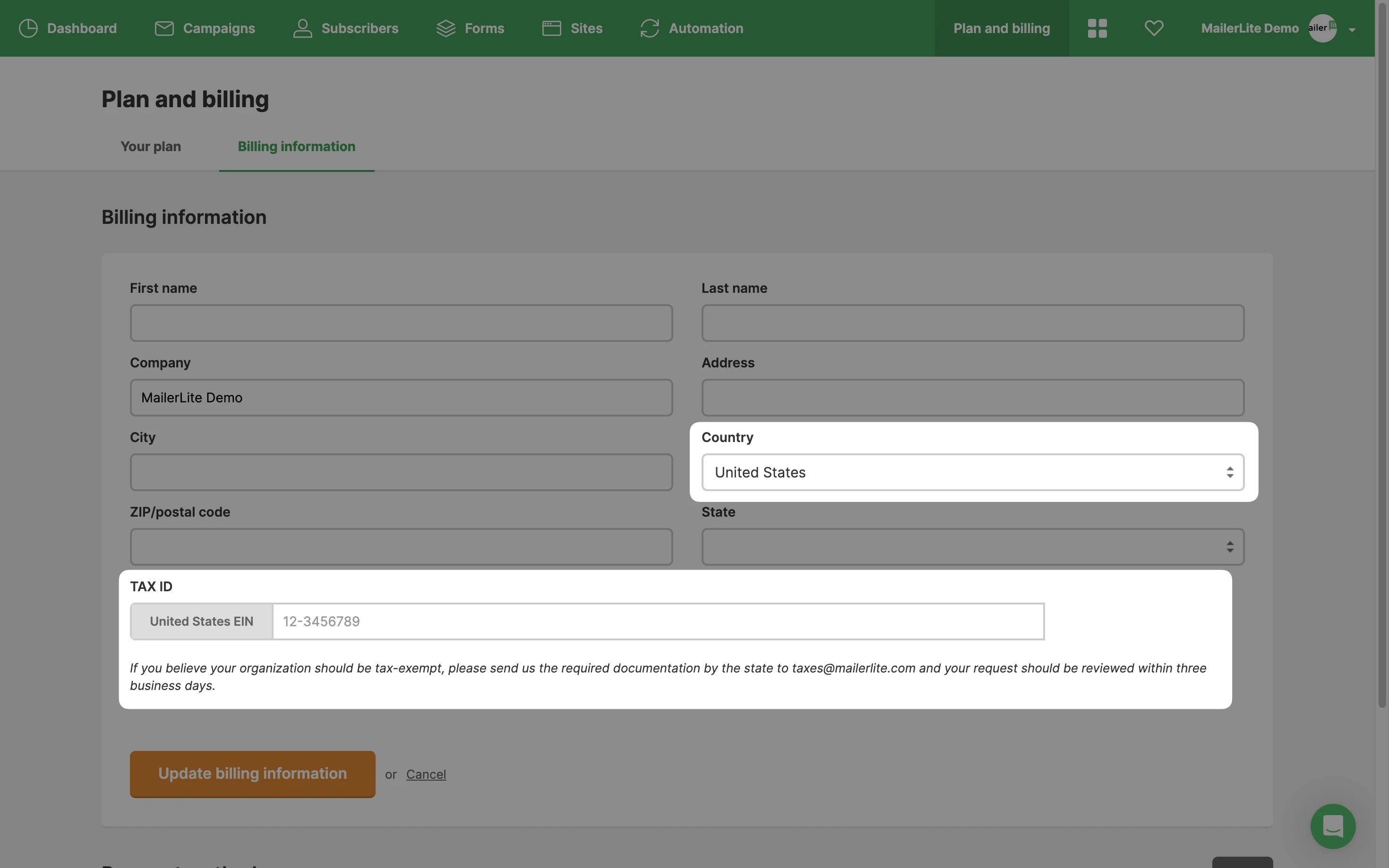

This combination may lead to several different rates applicable within each state depending on the zip code that is provided on the billing information on the Plan and billing page.

Based on the zip code you provide, our billing platform will calculate the applicable tax rate on top of the plan price on the checkout page. The tax component (state and local tax) will be identified in a dedicated line in the invoice of the purchase.

Tax exemptions

Certain charitable, religious, scientific, or educational organizations may be exempt from the sales tax. However, not all non-profit organizations qualify for a tax exemption.

If you believe your organization should be tax-exempt, please send us the required documentation by the state to taxes@mailerlite.com and your request should be reviewed within three business days.

Ohio: The state of Ohio requires you to submit a completed Ohio Sales & Use Tax Blanket Exemption Certificate (STEC-B) or a Streamlined Sales and Use Tax Agreement.

Utah: The state of Utah requires you to submit a completed Utah Exemption Certificate (TC-721).

Maryland: To apply for an exemption certificate, the state of Maryland requires you to complete the Maryland SUTEC Application form.

District of Columbia: The state of District of Columbia requires you to submit a completed Certificate of Exemption, which is issued by the local government.

Pennsylvania: the state of Pennsylvania requires you to submit an Exemption Certificate (Form REV-1220AS).

Massachusetts: the state of Massachusetts requires you to submit a copy of Form ST-2 and a completed ST-5. To obtain a duplicate Form ST-2, contact the Massachusetts Department of Revenue in writing, online, or by phone. Please send us both forms.

Washington: the state of Washington requires you to submit, depending on the category your organization falls into:

Youth character building organizations: RCW 82.04.4271 or RCW 82.08.0291

Student loan debt and guarantee organizations: RCW 82.04.367

Credit and debt counseling services: RCW 82.04.368

Organizations operating sheltered workshops: RCW 82.04.385

Certain fraternal and beneficiary organizations: RCW 82.04.370

New York: The state of New York requires you to submit a completed Application for an Exempt Organization Certificate

Texas: The state of Texas requires you to submit, depending on the category your organization falls into:

Kentucky : The state of Kentucky requires you to submit a valid exemption (Purchase exemption Certificate) or resale certificate from buyers to validate each exempt status.

West Virginia : The state of West Virginia requires you to submit a properly completed Certificate of Exemption [SSTGB Form F0003].

Vermont : The state of Vermont requires you to complete and submit to the Vermont Department of Taxes a Form S-1. The Department will notify the organization whether it has qualified for or been denied the exemption. The organization must present its certification of exemption to the vendor to make the purchase free of sales tax.

Tennessee : The state of Tennessee requires you to submit a Sales and Use Tax Certificate of Exemption from the Department of Revenue before making tax-exempt purchases.